Charging towards a sustainable future?

Steel - enabling the rapid transition to electric propulsion

By TATA Steel Europe 2017

Introduction

For over 100 years, the majority of motor vehicles have relied on burning fossil fuels via an internal combustion engine as their primary means of propulsion. However, an increasing number of factors are driving the rapid move towards the use of vehicles powered either partly or fully by electricity. At Tata Steel we view that we are at the start of the most significant period of change in automotive history. This report follows a detailed review of transport electrification and proposes a roadmap towards zero emissions for road transport.

Environmental legislation has been the primary catalyst for the automotive industry to move towards alternative propulsion systems. The burning of fossil fuels has been proven to be harmful in many areas ranging from global warming through to air pollution and the resulting loss of life due to respiratory diseases.

The most significant environmental target in Europe relates to CO2 emissions at the tailpipe. The EU has defined a series of CO2 limit targets applicable to all cars sold in Europe. The 2015 target was set at 130g of CO2 per kilometre travelled. For every manufacturer selling into Europe, the average of the fleet sold is measured, and for every gram of CO2 over the target, the vehicle manufacturer faces significant fines. This CO2 target will reduce to 95g per kilometre in 2021. Car manufacturers are therefore urgently developing solutions that either greatly reduce or eliminate emissions. This can be achieved by using electricity to power electric motors to drive the wheels. Electrifying the propulsion system partially or fully will lessen or remove the need to burn fossil fuels – or decarbonise the powertrain.

Environmental legislation is not the only driver. Recently other factors have helped to speed up the introduction of electrification. ‘Dieselgate’ really brought to the attention of the media and public the fact that current environmental testing is not reflective of real-world driving. It also highlighted that pollutants other than CO2 such as NOx are harmful to air quality and public health. This has stirred many cities to radically review the use of diesels in city centres.

Connected and autonomous vehicles (CAV) are receiving significant attention and funding. It is believed that the CAV future lies in electrification and the link to ‘smart cities’. It is likely that CAV developments could pull forward the automotive electrification timeline.

Another less obvious factor is the emergence of disruptive entrants into the automotive industry. Tesla has gained significantly disproportionate media attention given their extremely low production volume to date. However, Tesla has helped to pave the EV market for major OEMs. As

other entrants such as Google, Apple and Faraday also enter the market, so the major OEMs will have to respond.

Response from automotive manufacturers

According to the European Environment Agency (EEA), the average CO2 emissions from vehicles sold in the EU in 2010 was 140g per km. By 2015 the EEA derived data showed that this average was 119g per km which is far below the nominal 130g per km legislative target (although the actual target is weight dependent). It seems that all OEMs comfortably met this target. How did the OEMs meet this goal? The simple answer is through improvements to the conventional ICE. Over this 5-year period, both diesel and petrol ICE reduced the average CO2 emissions by 15% (according to the test cycle used). The target was not achieved by a significant shift to electrified powertrains. When considering electrified powertrains such as hybrids (full and plug-in), fuel-cell and full battery, and therefore ignoring alternative ICE fuels, in 2010 they contributed much less than 0.5% of the total vehicles sold in the EU. By 2015 this improved only to 1-2%. A significant growth, but still an extremely small proportion of the market.

Lightweighting of vehicle had a positive, but minor impact on the improvement in emissions. However, the average vehicle mass of vehicles sold in the EU actually increased (~1%) in the period 2010 to 2015. There are a number of reasons why the vehicle mass increased. Vehicles, generation by generation continue to get bigger in footprint and volume. The classification mix of vehicles bought by the customer continues to change with a trend towards sports utility rather than so-called family saloons. Cars now feature increased levels of safety equipment, in-car entertainment and connected devices. The list goes on. It is clear that structural lightweighting has helped to minimise the mass increase. Much of this is thanks to smarter use of advanced steels as there has not been a significant shift towards non-ferrous materials during this period.

Estimating the future response from automotive manufacturers

There are many opinions relating to what the transition roadmap from ICE to fully electric will look like. However, the range of roadmaps presented in the public domain have significant spread so it is challenging to combine into a consensus view. For this reason, Tata Steel has developed a ‘bottom up’ propulsion mix roadmap based on the technical needs of individual OEMs to meet their future legislative targets.

The ‘bottom up’ approach considers what mix of propulsion systems each individual OEM might adopt to meet different legislative targets (e.g. 2021 EU 95g/km). For this approach, it has been estimated that each

decarburisation of the new passenger car (PC) and light commercial vehicle (LCV) by 2050. To achieve this goal, new car sales will accelerate the migration towards mainly BEV, with some FCEV at the expense of fossil fuelled powertrains. This assumes that the current trajectory for technology improvement and cost reduction is maintained without any major political or economic disruption. Furthermore, it is assumed that infrastructure will be appropriately developed to support this migration.

Sensitivity of the roadmap

The TSE roadmap is built from an estimated future legislative roadmap. Any changes to the assumptions used for legislation beyond that confirmed for 2021 will affect the roadmap. To test the sensitivity of the roadmap to potential changes in timing or severity of future legislation, two additional scenarios are considered.

Alternative scenario 1: increased emission target

The first considers the scenario where the severity of the 2030 target is increased from the baseline, but with the aim to still achieve a fully decarbonised sold fleet by 2050. For this scenario the 2030 target is reduced to 50g/km from 70g/km. To achieve this target, it has been assumed that a range of issues have been overcome or have improved considerably from the position today. Example issues include infrastructure readiness (e.g. charging points, speed of charging), taxation (displace carbon based taxation), customer readiness, cost, recycling/reuse and end-of-life.

Alternative scenario 2: delayed roadmap

The second scenario considers the potential delay in rolling out legislative targets beyond 2021. This is reflective of the timing challenges that were faced when the original 2015 target was developed and agreed. The reason being that the European automotive industry is politically sensitive with many countries reliant upon revenues from this industry. It is therefore not inconceivable that the next target will take some time to agree. Couple this with the significant investment needed to improve the

electrification infrastructures and the potential impact on revenues from carbon taxation, there is every likelihood that future targets will be either lessened or delayed. This scenario therefore considers the 2030 target to be 80g/km tailing down to a 20g/km by 2050.

Role of steel as a consequence of transport electrification

The role of steel should be viewed by considering its use in the vehicle structure and the electric propulsion system.

First looking at the vehicle structure, which in this case includes the main body structure, hang-on panels such as the door, hood, etc., wheels, chassis and interior structures such as the seats.

OEM will adopt propulsion systems that they have commercialised already, or where it is known they will commercialise shortly.

There are no CO2 legislative targets in Europe beyond 2021, so estimations have been made up to 2050. For the baseline assumptions used in the ‘bottom up’ assessment, it has been assumed that the target for cars sold in Europe is 70g/km by 2030 progressing to zero tailpipe emissions by 2050. This is consistent with indications from the European Parliament and Government level commitments for 2050.

Estimations on car sales have also been made for the assessment. Sales projections towards 2023 are available in detail, but there is little reference data beyond this timeframe. It is projected that the EU compound annual growth rate (CAGR) for 2015-2021 is 1.7% (compared to 1.9% CAGR 2010-2015). Projecting beyond 2021 to 2050 is a challenge. There are many papers on the potential impact of mega cities on vehicle production with some surmising that more car sharing will lead to lower car ownership, whilst others take the view that demand will grow in line with population growth (either naturally or through migration). For this

reason, a balanced and conservative growth has been used for the future vehicle production estimations (CAGR 0.9% 2021-2030, 0.5% 2030-2050).

Baseline roadmap

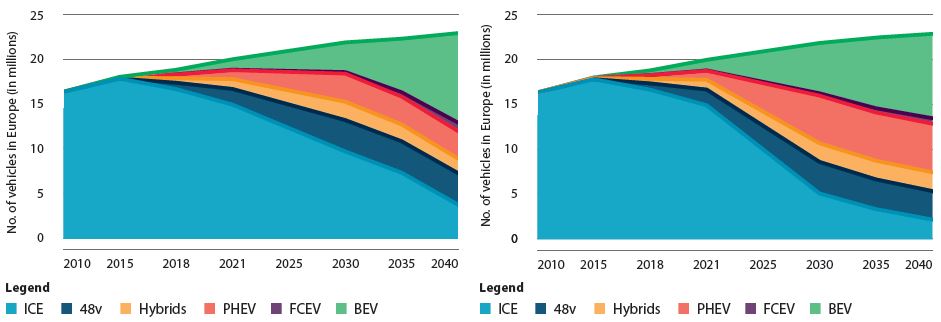

The individual OEM propulsion system roadmaps needed to achieve the default targets have been combined at European level into chart 1.

2015: the percentage of electrified vehicles is 1-2% of new car sales. There is a bias towards hybrid vehicles (PHEV) with relatively limited, but growing BEV.

2021: 2021 is the first year to require full adherence to the 95g per km legislation. To achieve this target, it has been estimated using the ‘bottom up’ approach that electrified vehicles must approach 15% of new vehicle sales (excluding 48v systems), with BEV and PHEV (plus limited fuel cell vehicle (FCEV) sales) accounting for around 11%. The bias could be towards BEV (around 60:40 split in favour of BEV in comparison to the 2016 50:50 split).

2030: based on the assumption that the EU target will be strengthened towards 70g per km CO2 emissions, the electrified mix must increase towards 40% with around half of these sales being zero emitting at the tailpipe (FCEV and BEV). The use of PHEV will grow to around 15% as the infrastructure to continues to catch up to demand meaning that BEV sales are ‘throttled’ to 15%.

2030 – 2050: it is assumed that Europe will aim for full transport

Chart 1: Combined propulsion system roadmap for Europe Chart 2: Roadmap resulting from increase emissions target for Europe

Chart 3: Roadmap resulting from delayed legislation introduction for Europe

Ιone only reviews the electrified vehicles currently in the market, it could be concluded that there is no clear link between powertrain and material choice. Around 10 years ago there was a view in some quarters that to accommodate very expensive battery packs needed for BEVs especially, the vehicle structure must be constructed from low density materials such as aluminium, carbon fibre and magnesium. However, on the whole, this has not happened. Many partially or fully electrified systems such as hybrids, fuel cells and full battery systems on the roads today have been retrofitted to existing, mainly steel intensive vehicle structures. The reason for this is partially related to rapid improvements in battery technology and also lightweighting achieved through the deployment of new and advanced steels, but the major reason is cost or affordability.

Car manufacturers have had to factor that the mass market consumer will not pay a premium for their vehicle. The early adopters who are driving around today in BEVs or even PHEVs have paid a premium, despite the many subsidies available. Early adopters typically pay for the privilege of being first but when a technology becomes mainstream, the majority of consumers will not. It is likely that once the sales reach a critical volume, existing subsidies will be unaffordable and will stop. The average consumer will not want to pay any more than they are paying today.

There also remains significant challenges with electrified vehicles: batteries remain expensive, bulky, heavy, have limited range, are relatively slow to charge and offer significant challenges end-of-life. Lightweighting will help with some aspects but not all and it is far more efficient to spend money on battery technology than significant spend on saving a few kilograms of body mass through the application of non-ferrous materials.

There are examples where OEMs have utilised non-steel vehicle structures for their electrified systems. The much publicised BEVs from Tesla are currently constructed from a mixture of aluminium, titanium and steel. However, the new model from Tesla (model 3) which will be produced in relatively high volume will be constructed from steel. The reasons are linked to lower cost, improved quality, faster build times and for their customers, reduced insurance premiums.

Whilst many OEMs view material strategies in different ways, they all anticipate that whilst ICE systems – either full or hybrid – are dominant, the need for lightweighting will remain a high priority. Lighter vehicles can be powered with smaller, more efficient engines, or as in the case with hybrids, lighter vehicles can directly help increase electric-only powered range.

The steel roadmap considers the what materials and technologies are needed to meet tomorrows lightweighting goals.

end-of-life.Steel has a significant advantage over alternative materials – it is easily segregated, it is easily disassembled, it is infinitely recyclable – and can be upcycled. Materials such as CFRP perform poorly during end-of-life; they are difficult to segregate, cannot be recycled and need to be scrapped as land fill.

Today, our customers are building environmental models in preparation. They are starting to view the trade-off of adopting low density, non-ferrous materials for increased lightweighting potential to help reduce running emissions against the significant penalty inflicted at the cradle and grave of a vehicles life. Our customers are confirming that steel has compelling propositions throughout the full life cycle.

For the steel market size assessment detailed later in the report, a conservative set of assumptions have been adopted regarding steel context. It has been assumed that the overall level of steel content will reduce in the vehicle structure over the midterm. This reduction will be a consequence of an increased use of advanced high strength steels for substitutional lightweighting, but also partial migration towards non-ferrous materials.

Long-term, it is expected that steel content will plateau or even marginally increase as a consequence of LCA benefits and also much lower pressure on lightweighting due to infrastructure recharging improvements.

Electric propulsion system

All electrified vehicles will require one or more electric motors as either the primary or secondary means to drive the wheels. Electrical steel is an essential material in the construction of electric motors. By tailoring the electrical steel grades, different motor performance can be achieved. This will become extremely important to the OEM as they look to differentiate their powertrains from those of their competitors. Higher performing electrical steels can improve the motor efficiency which will help to either extend the range of the car or increase the dynamic performance of the car. For a given range, efficiency improvements can help to take out tens of kilograms of battery pack mass and therefore system cost.

Engineers are now working with Tata Steel to deploy our advanced electrical steel grades to tailor motor performance. The steel market size and mix therefore factors a change in qualities of electrical steel grades used in electric motors.

Chart 4: Estimated steel demand assuming baseline roadmap

It is understood that in order to improve the efficiency of future electrified vehicles, new vehicle architectures will be tailored around the propulsion systems. These architectures will still need to meet core design parameters such as external package limitations, safety requirements, occupant and luggage space. However, cost-effectiveness will remain important – alternative propulsion systems are expensive and consumer affordability needs to be factored. Steel has very relevant cost-effective lightweighting propositions and it is our view that steel will remain the material of choice over this period.

What if we look further into the future, what next for lightweighting?

Today, the need to save mass for the battery electric vehicle is clear. The consumer is used to achieving a few hundred kilometre range from a conventional gasoline powered car. Historically, to achieve a comparable range using a BEV, a very large, expensive and heavy battery pack is needed. A lighter vehicle structure will help reduce the associated mass spiral – heavier battery pack leading to increased secondary mass effects such as larger brakes. But what about when the charging infrastructure takes away the need for long range capability?

Imagine the scenario where your future BEV has been fast-charging overnight at home, you take your journey to work and the road system wirelessly trickle charges your vehicle and when you reach your place of work, your car is again automatically charged. In effect your vehicle is continuously charged. Why would you need the vehicle to have a 500 kilometre range? Why would you need a heavy and expensive battery pack? Does the need for lightweighting remain as high as it does today? This future is fast approaching and it offers many opportunities.

This scenario could have a significant impact on material selection. However, there is a driver on the horizon that could arguably have an even bigger effect on what materials are chosen in the future. This driver is environmental sustainability.

Today’s vehicle are judged on tailpipe emissions. However, there are many experts arguing that to achieve a more sustainable transport sector, simply measuring tailpipe emissions is insufficient.

The most complete method of assessing sustainability is through Life-Cycle Assessment (LCA). LCA maps the full cradle to grave environmental impact of a vehicle – environmental impact to make the car – including raw material production, the fuel or energy production impact and the running impact and the disposal impact at the end-of-life.

The production of electric vehicles is typically more energy-intensive than for conventional vehicles. Large amounts of energy are needed to make systems such as the battery pack, but also electrical systems can contain high levels of rare earth metals.

Different material families also have varying environmental impact. For example, to produce the material needed for a functionally equivalent automotive component, compared to AHSS, the level of greenhouse gases emitted during raw material production is around four times higher for aluminium and six times higher for carbon fibre reinforced plastic (CFRP). Material production and processing could therefore significantly contribute to the final, combined environmental impact of a vehicle.

End-of-life vehicles create many millions of tonnes of waste each year. Existing EU legislation, including the EU directive on end-of-life vehicles, aims to reduce waste and encourage recycling of scrap vehicles. The large batteries and additional electrical components available for recycling, including the electric motor and its magnets, are challenging to sustainably dispose or recycle. The choice of material mix also has implications for

A key part of the electrified propulsion system will be the energy storage. Since 2010, manufacturers have coalesced around lithium-ion batteries in virtually every electrified vehicle application with a few notable exceptions from Toyota (who now look likely to adopt this technology rather than nickel metal hydride). Lithium-ion batteries are currently manufactured in three different physical battery cell formats; cylindrical, prismatic and pouch. Cylindrical cells are the most relevant to steel as prismatic and pouch are generally packaged in a non-ferrous casing, whereas cylindrical cells are packaged within a nickel-coated ‘can’. Cylindrical cells are the preferred solution for many OEMs. The reason why these cells are likely to be the most common, especially in the immediate future is that they offer one of the lowest costs in terms of energy storage, have good reliability, are relatively easy to manufacture with good mechanical stability. Steel has an important role to play in this technology, certainly in terms of cost effectiveness and sustainability.

So far many of the batteries used in Europe’s electrified vehicles are imported from the Asia. This is likely to change as demand grows with the need to make batteries much closer to the vehicle assembly plants for reasons relating to cost and most importantly, safety. Industry sources have estimated that globally there will need to be around 24 battery gigafactories to serve the 2030 global electrified vehicle demand, with at least six needed in Europe alone. This represents a significant growth opportunity for steel in this area of the vehicle where traditionally there has been negligible demand.

Another overlooked area is infrastructure needs to support the recharging of battery packs and the hydrogen refuelling of fuel cell electric vehicles. It is clear that although the rate of infrastructure improvements is speeding up, there is a long way to go to meet the future demand. This report does not detail this opportunity so further work should be undertaken. However, there will be significant steel demands to support the infrastructure construction ranging from charging points or stations and grid furniture through to transformers and powerstations but also ‘mega city’ developments where zero emission connected and autonomous vehicles will surely be needed.

Impact of transport electrification on steel demand

The steel demand has been estimated using the baseline roadmap combined with the associated assumptions on vehicle structure weight reduction, electrical and plated steel consumption in motors and batteries, respectively, combined with European vehicle production growth.

It is projected that the demand for ultra-low emission vehicles (ULEV) will drive growth in steel supply to the European automotive industry by

4.2 million tonnes between 2015 and 2050. A significant proportion of

this growth is expected in steels needed for battery and electric motors (1.6 million tonnes). However, there will also be an increasing demand for advanced high strength grades needed to cost-effectively, and sustainable achieve vehicle safety and lightweighting targets.

The volume progression is reflective of the anticipated effect of rapid growth in electric propulsion systems – affecting electrical steels and plated steels for battery casings, and also short-medium term pressure on lightweighting before environmental sustainability factors start to significantly influence material selection in the vehicle structure.

The chart below shows the sensitivity of steel demand for the different scenarios.

■ Delayed roadmap: as there is less pressure to adopt electrified propulsions before 2030, there is less emphasis on vehicle lightweighting as well as a lower demand for battery cells and electric motors. This delay also allows additional time for electrification technology to mature. The overall effect is a positive increase in steel demand compared to the baseline.

■ Increased emissions target: the urgent need to meet more stringent emissions targets earlier than the baseline will lead to a greater need to lower vehicle structure weight whilst battery and electric motor technology matures. However, there will be a greater demand for premium plated and electrical steels in line with a higher proportion of electrified vehicles in the scenario roadmap.

■ Electric motors: motors will be the way of converting energy, whether it is from fuel cells or batteries into forward motion. Motor technology will clearly continue to develop as engineers strive for efficiency improvements. There are two areas where Tata Steel is having an important role. The first is in working with our customers to help them understand how best to utilise the different electrical steel products for optimal performance. The second is to help develop supply chains to support the rapid growth in electrical motor production.

■ Infrastructure: the current infrastructure cannot support the future demand for re-charging of BEV or re-fuelling of FCEV. There are numerous opportunities ranging from material supply for charging points and grid furniture, through to transformers and powerstations and also ‘mega city’ developments where zero emission CAV will be needed.

Chart 5: Comparison in steel demand between roadmap scenarios

It can be concluded that the steel demand will increase, albeit at marginally lower growth levels compared to the vehicle production, but the overall value of this steel demand will increase substantially.

What opportunities will there be for Tata Steel?

There are four areas where Tata Steel offers compelling propositions in the field of vehicle electrification: vehicle architecture, batteries, motors and infrastructure.

■ Vehicle architecture: vehicle lightweighting will remain essential irrespective of propulsion systems. However, lightweighting must be affordable and Tata Steel’s current strategy to develop cost-effective advanced and ultra high-strength steels products along with supporting services will remain essential.

■ Battery pack: battery technology continues to develop at a rapid rate. There are different battery technologies being deployed, and steel has an important role to play in one of these technologies; cylindrical batteries, which is likely to be the dominant form. Tata Steel has developed solutions to current and future issues around cylindrical batteries including advanced coatings or plated steels for the steel cans and thinner layers for improved battery packaging.

Conclusions

It can be concluded that when combining the estimated OEM electrification roadmaps into a single European level roadmap, there will need to be a significant acceleration in cars made and sold with propulsion systems that are capable of running zero tailpipe emissions. By 2021 approximately 25% of vehicles sold in Europe must be ULEV, but with the bias towards ICE-hybrid systems. By 2030, this proportion could be over 40% with fully electric vehicles having a significant contribution to this mix.

Material choice will support any rapid growth in transport electrification. Vehicle structure lightweighting will remain relevant, certainly in the short to medium term, but mass saving must be achieved cost-effectively. The vehicles must be affordable to the mass market to realise the roadmap. Looking longer-term, it is expected that the environmental performance of vehicles will be judged on Life-Cycle Assessment rather than tailpipe. Steel has the most compelling proposition in this assessment, especially compared to low density alternative materials.

As the demand for conventional internal combustion engines diminishes, so will the demand for engineering steels typically required for the manufacture of ICE components such as connecting rods, cam-shafts, transmission shafts, etc. But this drop in engineering steel demand will be compensated through the growing demand for new flat steel automotive products. Electric propulsion systems need advanced electrical steel grades for electric motors, and for energy storage, advanced plated steels for battery casings.

We are facing a fast-moving and exciting time in the road transport sector. Tata Steel is well prepared for this future, and will continue to develop relevant and compelling solutions. We truly believe that steel will remain the material choice as we take the journey towards full transport electrification.

Optimising front and side structures with complex phase steels

by TATA Steel Europe 2017

www.tatasteeleurope.com

Background

The general trend of lightweighting in the automotive industry does not wane. On the material level, R&D departments are constantly searching for ways to make components even lighter to help meet the current and coming regulations for CO2 and fuel consumption. As the Body-In-White (BIW) represents a considerable amount of the car’s weight, which is mostly made of steel, the steel industry is developing new material solutions that help to reduce weight further.

Advanced high-strength steels (AHSS) offer a good solution to achieve this goal. Depending on the requirements of a car manufacturer, other factors – such as the end product performance or the production cost per part – need to be taken into consideration. With new steel grades and technology to comprehensively assess their potential, Tata Steel is now able to determine the most suitable steel for a particular component. The company offers an ever-growing range of metals with different properties, plus a set of accompanying services that can show manufacturers their optimal balance between lightweight potential, performance and costs according to their priorities.

Supporting steel selection

To identify an adequate steel grade that can reduce weight in the front and side impact structures, the company conducted several tests with its high strength CP800 complex phase and DP1000LY dual phase steels. These steels are supposed to be able to replace the commonly used DP800 dual phase steels in parts like sills, seat cross members and A-pillars. In addition to the weight reduction potential, Tata Steel compared their performance, manufacturing behaviour and related costs so that manufacturers can consider all these parameters during the selection of the material.

When looking at the lightweighting potential of a material for BIW parts two other material properties remain central: their performance during a crash and their manufacturability during the

deep drawing process. The crash performance of steel largely depends on the bendability of the material – relating to the yield strength – while good manufacturability is related to the stretchability of the material. The higher strength required for the weight reduction, unfortunately, coincide with decreased levels of either the required bendability or stretchability (image 1).

Image 1: Specific formability developments HyperForm® for stretchability

To optimally meet the requirements of car manufacturers for various parts, Tata Steel is currently developing and extending its steel families A manufacturer therefore has to define which limitations are acceptable for a particular component.

Crucial crash performance

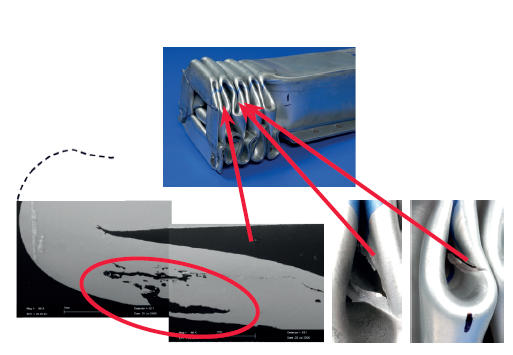

To support manufacturers in their selection, Tata Steel assessed the crash performance by studying the bending and fracture behaviour of a closed top hat (image 2). Here, bending is very apparent in a crash and the study of the fracture location and appearance indicates that failure through shearing is a common result. For safety reasons, generally as much energy of the crash as possible should be absorbed in the bends.

Image 2: Type of fracture in crash

Study of fracture behaviour „Closed-Top-Hat”

Image 3: Elongation and bending performance of steel products

A three point bend test with a bending VDA angle at 1mm and a shear test measuring the failure strain, in a comparison between DP800 (image 3), DP1000 and CP800, showed that the CP grade offered much better performance for bending and shearing than the DP grades, resulting in a better crash behaviour. This can be related to the different microstructure of CP800.

To further examine the crash performance for sills and seat cross members, Tata Steel simulated and compared the side impact of a crash on components made of CP800 and DP1000LY using the Future Steel Vehicle (FSV) model (image 4). The simulation showed no major differences in the deformation of the components made of CP800 and DP1000LY, so both steel grades show an equivalent crash performance.

Image 4: Crash performance of CP800 versus DP1000LY

Side impact results for FSV model

Ease of manufacturing

To assess the manufacturability of components made out of CP800 and DP1000LY, a forming analysis for an A-pillar lower, a critical forming part, was conducted for the first draw of the deep drawing process and after flanging/cutting. The simulation showed a slightly better formability of DP1000LY compared to CP800, which is related to the better stretchability of dual phase steels. For the lower A-pillar, this does not have to be critical and can be solved with minor geometric adjustments to the layout if necessary. Nevertheless this indicates that, for components with more complex geometries, DP1000 steel is somewhat better suited to achieve lightweighting in other areas.

Quantifying the costs

To complete the assessment, Tata Steel conducted a cost analysis for the new grades related to each of the tested parts. The analysis showed a clear cost benefit for CP800 compared to DP1000, ranging from 0.03 Euro for floor cross beams, 0.12 Euro for the A-pillar reinforcement, and up to 0.18 Euro for a sill.

Conclusion

Advanced high-strength steels have the potential to reduce weight throughout the entire BIW. However, the variety in steel grades with different properties offer even more than that, and Tata Steel is able to support manufacturers in the assessment of materials to meet the exact requirements in regard to safety, performance, lightweighting and costs for particular components. The present study proves that CP800 can compete with DP1000LY when it comes to lightweight design of crash components. CP800 shows a similar formability and crash energy absorption potential as DP1000LY, but against lower costs, making the steel particularly interesting for mass production applications.

HyperForm® offers affordable weight saving steels for the entire car body

Extra formability tackling weight, costs and performance simultaneously

by TATA Steel Europe Limited 2017

www.tatasteeleurope.com/automotive

Extra formability tackling weight, costs and performance simultaneously

Thanks to major efforts, and the development of various technologies that contribute to the reduction of CO2 tailpipe emissions, car manufacturers are currently doing well in complying with international regulations. One of the key technologies supporting the reduction is material light weighting. Here, the focus shifts from the mere reduction of CO2 to also lower the related costs, and considers manufacturing process efficiency as well as the end application performance. High-strength steels present a light and affordable solution with good crash performance for the car body. With considerable improvements in their formability over recent years, the latest generation of these types of steels can be applied to almost all areas of modern Body-in-White (BIW) structures and are easy to process at the same time.

Tata Steel was the first to start developing these formable, high-strength steels in 2008, with DP800-GI HyperForm®, the first grade of an entire product family, launched in 2011. Compared to conventional products, these special grades offer better stretchability at the same strength level and are easy to process due to the optimised chemistries. Today, the innovative concept behind HyperForm offers huge potential to be used for Body-in-White applications. In addition to building lighter cars, the use of this new generation of high-strength steels allows more innovative BIW designs and helps to substantially reduce scrap rates in the stamping process of difficult parts. This subsequently has a significant positive impact on sustainability and costs.

Revised norms broaden use of extra formable steels

Since 2009, various advanced and ultra high-strength steels have been incorporated to EuroNorm and VDA norms. In 2016, the new extra-formable steels were adopted into VDA 239-100 under the DH classification. Formerly seen as mere problem solvers for difficult parts, the acceptance of these steels in the standards allows their use in broader applications and enables car manufacturers to review the whole Body-in-White design with regards to further lightweighting potential right from the start of new car development. With four to five percent better elongation, compared to conventional dual phase steels of the same strength level, the HyperForm family facilitates downgauging of about 35 structural parts in the Body-in-White. Related cost implications are neutral, or even positive, as the higher material price is compensated by lower weight, a reduced material need, an improved press shop yield, and the opportunity to replace more expensive process solutions.

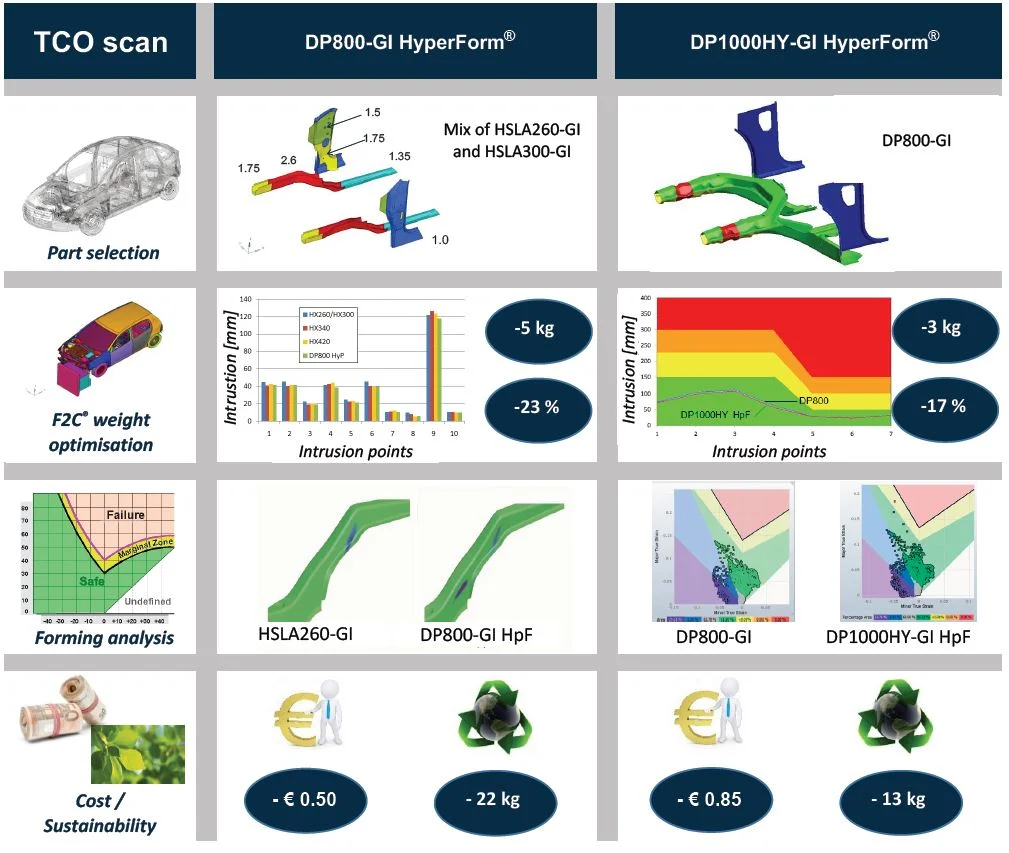

To assess the potential of extra formable steels for broader applications in the Body-In-White, Tata Steel supports customers with its technical service, TCO (total cost of ownership) scan. The service analyses further lightweight potential of high-strength steels, by calculating the maximum thickness reduction at the required strength level, taking into account the application and then quantifying the cost

benefits, CO2 impact, lightweighting and performance. To do this for the new HyperForm grades, these steels are checked in a four-phase process in the table shown below.

In the part selection phase, potential parts in the entire car body are identified and assessed with regards to their weight optimisation. In the Forming to Crash (F2C®) phase, the possible gauge reduction at an equal crash performance is determined. This is followed by the forming analysis, where the forming and stamping is simulated to assess the processing and manufacturing feasibility of the parts. In the final phase, the weight and cost impact of the chosen solution is calculated.

TCO scan on front structure parts

As representatives for numerous other parts in the car body structure, two front structure parts were chosen. For the front longitudinal, the base materials were HSLA260 and HSLA300, which were compared to DP600 and DP800-GI HyperForm. For another front structure based on higher strength, the A-pillar reinforcement, the base material, DP800, was compared to DP1000-GI HyperForm.

Initially, the formability benefits of the new high-strength steels were assessed compared to the conventional HSLAs. The DP800-GI HyperForm offered an up to 180 MPa higher yield strength than the HSLA260 and HSLA300 reference models. With a DP600 base with thicknesses from 0.9 to 2.0mm, the DP800-GI HyperForm still offered an up to 110 MPa higher yield strength. The DP1000HY-GI HyperForm presented an up to 160 MPa higher yield strength than its DP800 reference model.

In the second phase, the crash performance was calculated with the help of the Forming to Crash (F2C®) technology, which includes the increase in strength due to strain hardening by forming the part. The analysis determines the maximum possible gauge reduction to achieve an equal crash performance. For this, the reference model with HSLA was changed to DP800-GI HyperForm (DH800). The analysis showed a 23% downgauging potential per part without the loss of crash performance. For the other reference model, the DP800 baseline was replaced by DP1000-GI HyperForm (DH1000), the result of the analysis showed a downgauging potential of 17% per part.

The third phase of the TCO scan assessed the manufacturing feasibility of a specific part. Here, the outcome of the crash analysis with grades and thicknesses is checked regarding manufacturability. This stage demonstrates the benefits of the HyperForm grades: the extra formability that these grades offer result in an improved deep drawing capability which is necessary to obtain good parts at higher strength levels.

At the end, the weight and cost impact of the chosen solution is calculated. Comparing the reference models to DP800 HyperForm, the new steel showed a weight saving of up to 23%, which is approximately 5kg, with a similar crash performance and good feasibility. The lower weight of the parts resulted in reduced part cost of approximately 0.5 Euro. The DP1000HY-GI HyperForm when compared to DP800, achieved a weight saving of 17%, which is approximately 3kg and 0.85 Euro at a similar crash performance and good feasibility.

TCO Scan for DP800-GI HyperForm® and DP1000HY-GI HyperForm®

look into further lightweighting options to improve affordability and processability aspects while also achieving 2020 targets. Extra formable high-strength steels offer a huge weight and cost saving potential for car manufacturers developing Body-in-White components. The improved formability of HyperForm steels enables the use of higher strength materials and facilitates lightweighting. The adoption of these steels in the DH classification of the VDA 239-100 norm paves the way for a broader application of these materials in the entire Body-in-White design, saving up to 23% weight at minimally higher costs. HyperForm is therefore an attractive lightweighting solution to reduce CO2 emissions further to meet the requirements of the future.

When analysing these results and translating to the entire Body-in-White, the potential weight savings – also considering the cost implications – of using HyperForm are significant. By replacing conventional HSLA steels with HyperForm, the reduction in weight of two separate front structure parts are 6.5kg (DP800) and 4.1kg (DP1000) respectively. Considering those results for the full range of Tata Steel’s HyperForm products, applied to the whole BIW, impressive weight savings of 12.9kg can be achieved with a minimal cost penalty of just 0.13 Euro per car.

Conclusion

Although car manufacturers are making considerable progress in order to comply with international CO2 regulations, they should